Seminel was founded in order to address issues caused by inadequate implementation of IT systems in the Energy market.

Our clients are looking for assistance with Energy Trading and Risk Management software and our projects have ranged from:

- ETRM business analysis, package evaluation and solution design for a major Oil & Gas company

- Managing the implementation of ETRM solutions based on market-leading ETRM packages

- ETRM software development for the world’s largest investor-owned energy service provider

- ETRM vision and advisory role for a major European Utility

- Providing ETRM IT specialist consultancy for global IT consultancy.

Our consultants are all seasoned professionals with over 10 years experience in Trading and Risk Management and related applications and IT systems.

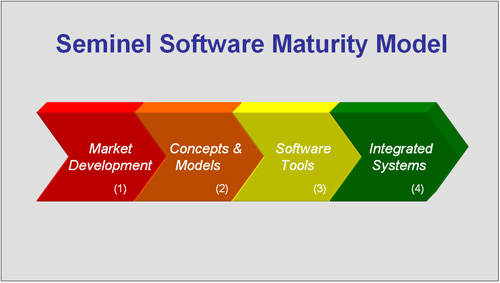

Additionally, Seminel has developed various concepts and frameworks to model the market, such as its Software Maturity Model:

This model depicts how market developments lead to the invention of new concepts. These are in turn coded into software tools (perhaps initially as spreadsheets), that are ultimately integrated into corporate systems.

For instance, applying the model to the Financial Markets, events such as stock market crash of 1987(1) can be seen as the precursor to the development of concepts such as VaR(2) and then to JP Morgan, for example, creating its RiskMetrics tool(3) for producing VaR, which it made available in 1995. Such VaR tools were subsequently incorporated into the Trading and Risk systems(4) that banks now use to manage their risk as well as calculate their capital requirements in accordance with Basel II (2004).

|